what is a rainy day fund?

rainy day funds are money that we put aside to use in times of unexpected work such as renovating your vehicle or paying for house maintenance. now hmm why exactly do we call it a ‘rainy day fund’ well cause just like you don’t know when is it gonna rain, you won’t be able to know when you’ll have to fund for those tasks or major life events.

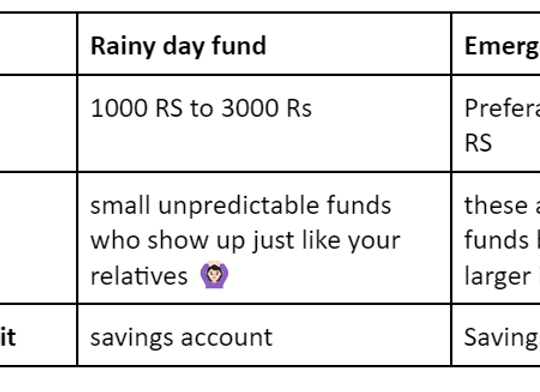

usually, folks misunderstand an emergency fund with a rainy day fund. but as a matter of fact, they’re very different from each other. an emergency fund is the savings that you do for a huge happening you don’t know is gonna occur in future. let’s say saving up for a date with your crush or saving for an amazing (but expensive) dress that has just come on sale.

how much should you have in a rainy day fund?

to be blunt, you can have as many savings as you want. rainy day funds are usually the small ones so you don’t really have to worry about it. but to be on the safer side, you can put a small amount of money every month in your rainy-day piggy bank. and hey, if you think you’ve saved too much, you can stop putting money in the fund for one month and pamper yourself.

ideally, you can have anywhere around 1000 rs to 3000 rs to cure your rainy day blues. your rainy day fund doesn’t need to be as huge as your emergency fund. you can evaluate your needs by taking a look at your expense book. and at the end, you can add the money to your account accordingly.

what expenses would your rainy day fund cover?

as mentioned before. You can use the rainy day fund to cover small expenses like fixing your bike tires or anything else that would seek your wallet’s help when it’s entirely empty. some other expenses that you can cover with this fund are-

- Medical bills

- getting your house repaired

- Getting your car serviced

- spontaneous date with your crush

- Urgent cash for your family members

where should you keep the money for the fund?

you should always keep the money in the count that you can easily access such as your akudo account. so that you can just use the money whenever you wanna. however, if you feel you might need the money spontaneously and you’re a teen without a card, you can also keep the money in cash.

how many months should you save for a rainy day fund?

as we said earlier too, a rainy day fund budget depends on your way of living. If you’re a teen with high maintenance stuff and a car (or a demanding girlfriend) you’d have to separate a larger sum of money in the rainy day fund. or the other way is to take out a small sum of money every month. you can pause after 4-5 months if you haven’t used that money.

but if you’re single with a bicycle and let’s say good savings then you can take out a small sum of money for like 2 to 3 months.

what is right for me? Rainy day fund or an emergency fund?

if you take our opinion, you should be prepared to have both. if you’ve reached this part of the blog, you already know that rainy day funds and emergency funds are two different things.

someday you might need to spend small on an unpredictable task where you can use your rainy-day fund while on some days, you would need to spend huge and that’s when you take out your emergency fund. so in short, save for both the funds.

saving tips for a rainy day fund

we know it becomes very hard to save for these many funds. and we think we can help you here a little bit.

- start cooking in rather than ordering out (use that money in your rainy-day fund piggy bank)

- Start a side gig to prepare yourself for saving a little bit extra (have talent? Approach us and we’ll go for a coffee ☕

- take out a small amount of money whenever you return from your nani’s house

- Do chores at your home and take money from your parents in return

- try refraining from splurging after you receive money

- Create an auto-deposit so you won’t have to think twice before saving the money.

- Use your akudo card to save some extra bucks while shopping/ordering or pretty much anywhere (oh and did we tell you? You get awesome rewards too

we heard you like things simple, so here you go pals. If you didn’t understand the parts above easily, this might help you in taking a glance at all things rainy days.

last few words:

you never really know when a spontaneous expenditure might strike you the best way is to be prepared for it like a pro. one thing that you should NEVER do is keep all the money in the same account. not only would it be really confusing but you’d also be penniless when the moment of using rainy day fund comes by.

so what have you planned? do you just wanna be a teenager or you wanna be a smart teenager? Let’s get set and save some money to fight emergency money situations like a pro.